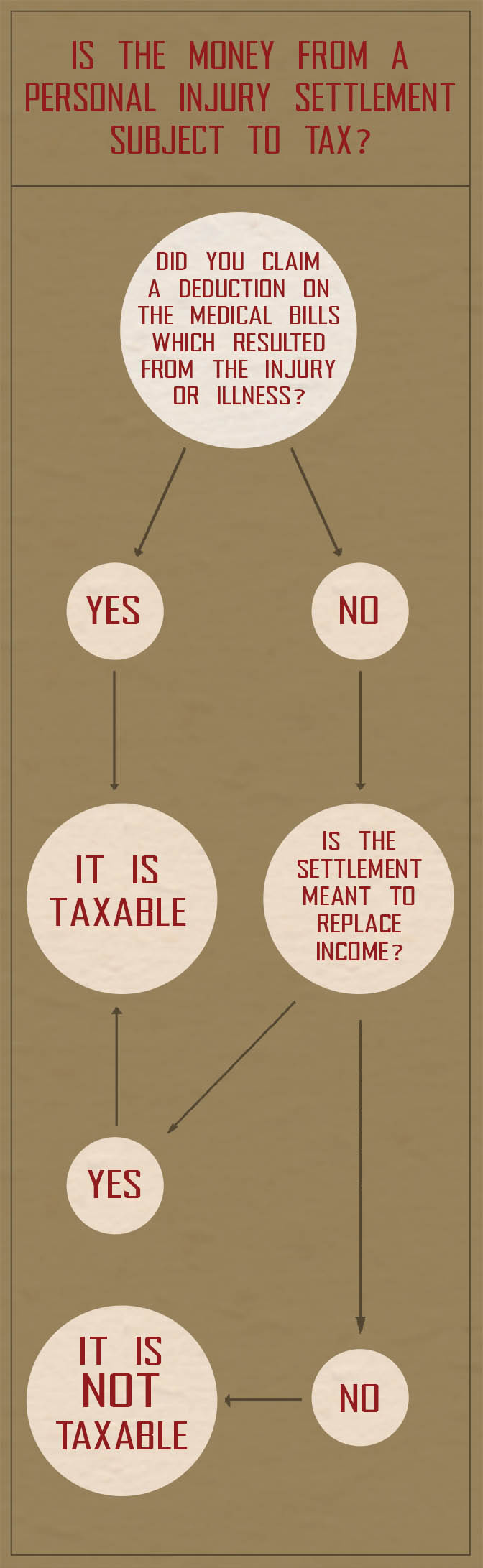

Just in time for the tax filing deadline: You’ve gone through the litigation and your personal injury lawyer has successfully secured a settlement for you the previous tax year. Your question: is this money mine in entirety? What are the most common scenarios and is the money from a personal injury settlement taxable?

Ordinarily No…

In general, the money that is received from a personal injury settlement is not taxable as long as it was received due to a physical injury or physical sickness. The IRS states that:

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income. (IRS)

In short, if you did not claim a deduction on the medical bills, which resulted from the injury or illness, the settlement money is all yours.

However, there are circumstances, which deem personal injury settlement cash taxable.

When is my settlement considered taxable?

In general, the Internal Revenue Service (IRS) will only seek to tax personal injury settlements if the settlement is meant to replace your own income.

Income Replacement:

In the event that your settlement is meant to replace income (e.g. employment discrimination or a lost profits claim from business) then the claim can be taxed. There are a few other instances that may be considered income replacement, so if this is something that you are worried about, it is important to consult a tax attorney to determine whether your settlement is taxable based on the unique circumstances of your case.

If your personal injury settlement is compensation for a physical observable injury, then the general rule is it will not be taxable. However, those are difficult quantifiers if the injury may be internal or mental.

Medical Deductions Have Been Performed:

The other specific instance where your personal injury settlement may be taxed is in the event that you have previously claimed medical expenses. According to Tax Attorney John Claudell: “if you itemize deductions and you claimed medical expenses in previous years as an itemized deduction that were later reimbursed by the settlement then that amount would be taxable.”

Essentially what the IRS is saying here is that if you have claimed the money as a deduction from your taxes previously then there is the chance that the personal injury settlement you have received will be taxed. The exact wording from the IRS website is as follows:

If you receive a settlement for personal physical injuries or physical sickness, you must include in income that portion of the settlement that is for medical expenses you deducted in any prior year(s) to the extent the deduction(s) provided a tax benefit. If part of the proceeds is for medical expenses you paid in more than one year, you must allocate on a pro rata basis the part of the proceeds for medical expenses to each of the years you paid medical expenses. See Recoveries in Publication 525 for details on how to calculate the amount to report. The tax benefit amount should be reported as “Other Income” on line 21 of Form 1040.

DISCLAIMER: The content posted on our web site is intended for informational purposes only and should not be regarded as legal advice. You should contact your attorney to obtain advice with respect to any particular issue.

Thanks for the taxes 101 diagram. I’d never thought about this before and it actually applies to someone in our family. I’ll pass this along – and keep reading. Love your blog!

Wow that is great information. I always just assumed that any awarded money would be not only taxable, but taxed before received. The diagram is perfect, and I will definitely share this post with my sister… I believe she received some bad – very bad – advice on this very subject. Thank you!

This was an informative article about personal injury settlements. The little info graphic was helpful in understanding when settlements are taxable. My Uncle has been thinking of filing a personal injury case. I will have to show him this information.

Emily Smith | http://www.starneslawoffice.com/about_us.html

Very nice post. Even if you suffer a physical injury or physical sickness, you will be taxed on damages relating to a breach of contract if it is the breach of contract that causes your injury, and the breach of contract is the basis of your lawsuit.

Remember that the settlement or verdict is non-taxable only as long as it arose from a physical injury. If, for example, you have a claim for emotional distress or employment discrimination, but no actual physical injury, then your settlement or verdict would be taxable unless you can prove even the slightest amount of physical injury.