While the notion might seem absurd, many wealthy people and celebrities have named their pets in their estate plans.

Designer Karl Lagerfeld, who died at age 85 in February 2019, wrote his beloved cat Choupette into his will four years before his death. The Burmese cat inherited a chunk of the fashion icon’s estimated $300 million net worth. However, the cat was already independently wealthy as it had earned over $3 million through modeling jobs.

Image Source: dailymail.co.uk

Leona Helmsley, the “Queen of Mean” who was convicted of tax evasion, left $12 million to her beloved Maltese Terrier “Trouble.”

Fashion designer Alexander McQueen bequeathed the same amount to each of his three dogs as to his housekeepers, godson and nieces and nephews.

In 1992, Karlotta Liebenstein, a German countess, left more than $65 million to her German Shepherd Gunther III. When Gunther III passed away, his offspring, Gunther IV inherited the estate.

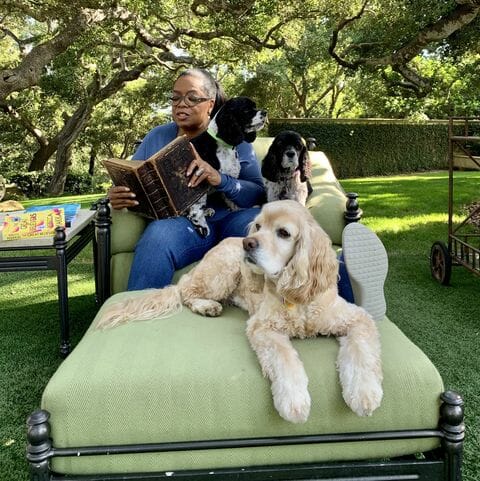

Image Source: oprahmag.com

It’s rumored that Oprah Winfrey has a trust, said to be worth $30 million, set up to care for her many dogs after she passes.

Are these wills and trusts honored by the courts?

Contrary to popular belief, pets cannot directly inherit any money or property through wills. After all, they can’t spend it. You can, however, leave money or property to the person(s) or organization(s) that will take care of your pet(s) once you pass away. Many states like California allows for trusts to be formed for the benefit of pets.

You can also consider leaving a “pet health care directive” allowing someone else to arrange for your pet’s health care in the event of your incapacity. A power of attorney can also give your designated agent the right to care for your pet.

The general advice is to use your estate plan to make sure that:

your pet goes to a caring person or organization, and

the new caretaker has the resources to take good care of your pet.

How Much Money Should Your Pet Inherit?

If you want to leave an inheritance to your pet but do not have $300 million to spare, you may be wondering what’s the adequate amount of money to set aside for your pet.

If you are considering leaving your pet or pets to an individual (e.g., a family member), you may want to set aside a lump sum to help them pay for the costs associated with your pet’s future care.

To determine how much money your pet should “inherit,” calculate your current annual costs to care for the pet(s). Then, multiply that amount by the pet’s remaining life expectancy. And do not forget to add some extra for medical care. If your pet is used to grooming and other perks of a luxury lifestyle, it may be a good idea to create a pet trust to manage that money for your furry friend.

Choosing Between a Will and Pet Trust

Once you have determined the appropriate budget for your pet to inherit, there are two ways to enforce your wishes in an estate plan: within your will or using a separate pet trust.

- A will is more straightforward and less expensive but carries its own risks. As with other types of property, you can specify in your will who will inherit your pet(s) upon your death and leave that person the appropriate amount of money to provide for the pet. In the will, you can state that the person would only receive the funds upon accepting responsibility for the pet. The most significant risk with this approach is that there is no way to ensure that the funds are spent on the pet. In other words, use this method only if you truly trust the chosen caregiver.

- Creating a separate pet trust allows you to get more control, though this option is costlier than a will. A pet trust lets you set aside the appropriate amount of money with specific restrictions as to how the funds will be used. In the pet trust, you name a trustee to manage the funds and make sure that the money is used solely for your pet.

What do you think? Are people nuts to leave so much money for the care of their pets? Should dogs, and not people, live in their mansions?

It’s their money they should be able to spend it any way they want to

I agree wholeheartedly, a dog can definitely make choices